In the complex world of business management, payroll stands out as one of the most intricate and demanding tasks, especially as workforces expand across international borders and companies adopt permanent flexible working arrangements.

On top of this, with a myriad of tax codes, pension regulations, and ever-evolving employment laws to navigate, UK businesses often find themselves mired in the complexities of payroll management.

Not only is the process time-consuming, but it requires meticulous attention to detail to avoid costly errors and potential legal issues. Furthermore, the traditional methods of payroll management often involve confusing spreadsheets, countless back-and-forth email chains, expensive service providers, and slow payment processing, adding to the burden. A fully cloud-based payroll tool like Pento, which is designed to alleviate these challenges, will make payroll management much easier.

With a payroll tool like Pento users can leverage the power of automation and seamless data integrations to streamline payroll management, making it quicker, easier, and more accurate. By automating key tasks and syncing with other systems, the tool transforms payroll from a tedious chore into a smooth, efficient process.

This article delves into three key payroll management tasks that Pento simplifies with automation, highlighting the problems they solve and the benefits of automation.

1. Identifying Issues Before Closing Payroll

Payroll management is fraught with potential pitfalls. Errors such as incorrect or missing employee information and miscalculations with auto-enrolment or PAYE can lead to significant problems down the line. The results might include incorrect payments to employees, tax discrepancies, and prosecution from regulators.

Moreover, rectifying errors post-payroll can be a time-consuming and costly process. Once payroll has been sent, there is a much more complicated and often bureaucratic procedure required to remediate it – especially when it comes to underpaying taxes.

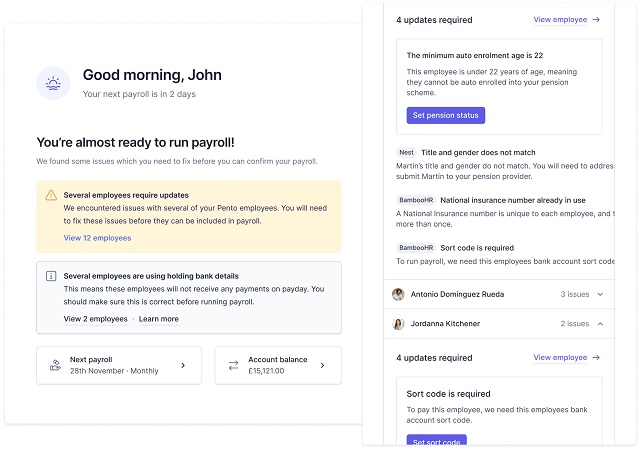

With this in mind, identifying and addressing these issues before closing payroll is crucial for efficient payroll management. Pento was built to help HR and finance teams avoid these snafus from the start. The platform offers businesses a proactive approach to payroll management by highlighting potential problems before they arise.

The tool will notify users if the system detects potential issues such as:

- Incorrect employee information

- Missing bank details

- Compliance issues, such as employees not meeting the minimum age for pension auto-enrolment

- HMRC and PAYE discrepancies

- Duplicate info, such as National Insurance numbers

Here automation essentially eliminates the need for manual checks, which can be prone to human error and oversight. Instead, Pento’s system scans payroll data for potential issues and creates a queue of flagged issues, allowing your team to address each one promptly.

It’s like having a second set of eyes that never tires and never overlooks a detail, no matter how small. This level of scrutiny is especially important in payroll, where even the smallest error can have significant financial implications.

2. Updating Employee Personal Details

In the dynamic business environment, employee details often undergo changes. Whether it’s a change in address, marital status, or bank details, these changes need to be reflected accurately in the payroll system.

Once again, the task of manually updating these details across multiple systems is tedious and error prone. All it takes is for a payroll officer to input inaccurate employee data, and it can lead to errors such as incorrect salary payments or tax deductions, causing financial discrepancies for both the business and the employees.

Pento, with its integration capabilities, connects with HRIS, accounting software, and pension providers. This integration allows for automatic updates of employee information as per the internal HR records. The need for manual data entry is eliminated, significantly reducing the risk of human error.

The process is simple. Businesses can connect the tool to their existing systems using API keys or login credentials. Once connected, it automatically syncs employee data across all platforms. This ensures that any changes in employee details are instantly reflected in the payroll system, leading to more accurate and efficient payroll processing.

3. Payments to Employees and HMRC

The process of making payments to employees and HMRC is another area where Pento’s automation capabilities shine. Traditionally, businesses needed to manually issue checks or wire transfers to each employee in accordance with payslip figures. They also had to ensure that the correct contributions were paid to HMRC, adding another layer of complexity.

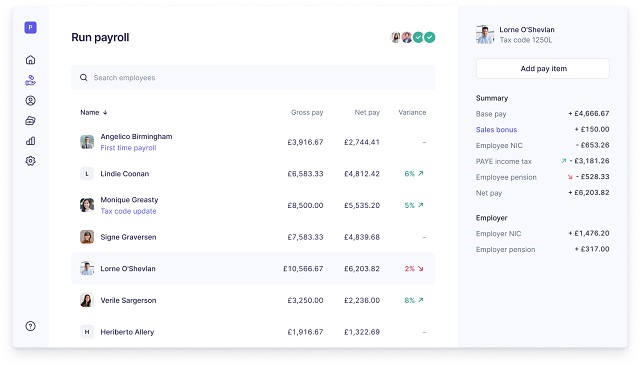

A payroll tool like Pento simplifies this process by automating the calculation and payment process. The software automatically calculates each employee’s net pay, considering all necessary deductions and contributions. It then makes the payments directly to the employees’ bank accounts, eliminating the need for manual transfers.

Similarly, the platform also automatically calculates the amount due to HMRC for PAYE and National Insurance. It then facilitates the payment directly from the business’s bank account to HMRC, ensuring that the correct amount is paid on time, every time. This not only saves time but also helps businesses avoid penalties for late or incorrect payments.

In addition, the tool provides a clear and detailed breakdown of each payroll run, including individual employee payslips and a comprehensive report of the total amount paid to HMRC. This transparency helps businesses keep track of their payroll expenses and ensures that all payments are accounted for. Moreover, it offers the flexibility to make changes right up until payday, providing businesses with greater control over their payroll process.

Conclusion

With a payroll management tool like Pento businesses can navigate the intricate landscape of payroll processes. By automating key tasks and integrating with key third-party systems, the tool simplifies payroll management, reduces errors, and saves valuable time. This efficiency allows businesses to redirect their focus from administrative tasks to strategic growth initiatives.

With its proactive issue identification, seamless employee detail updates, efficient payments, system integration, and robust reporting and analytics, the payroll management tool empowers businesses to reach their full potential. By transforming payroll from a complex, time-consuming task into a streamlined, efficient process, payroll software like Pento helps businesses to thrive.

Author Profile

- Blogger by Passion | Contributor to many Business Blogs in the United Kingdom | Fascinated to Write Blogs in Business & Startup Niches

Latest entries

BusinessApril 11, 2025How Hiring a Student Could Be the Best Move Your Business Makes

BusinessApril 11, 2025How Hiring a Student Could Be the Best Move Your Business Makes Living in LondonApril 9, 20255 Key Considerations for Long-Term Urban Rentals

Living in LondonApril 9, 20255 Key Considerations for Long-Term Urban Rentals EntertainmentApril 3, 20257 Slot Games that are Popular with Londoners

EntertainmentApril 3, 20257 Slot Games that are Popular with Londoners EventsMarch 25, 2025EGR Awards 2025: London’s Comeback After Losing ICE

EventsMarch 25, 2025EGR Awards 2025: London’s Comeback After Losing ICE