Have you ever received messages like these?

You have an outstanding tax refund of £200 from 2020 to 2021. Claim your tax refund at https://gov-tax.refundpr.com/

This link will then try to get you to enter your personal details.

Or,

HMRC has sent you this notification since your eligibility has been checked. We owe you 700 GBP. Click on this link to get your tax refund.

These are common HMRC tax refund scams that have been reported and anyone can fall prey to these, so it’s important to be aware of them and understand how to not fall for them.

What Is an HMRC Tax Refund?

If you’ve paid too much tax within the tax year, HMRC would owe you a tax refund.

Now, how would you be notified if you’re eligible for these refunds by HMRC?

If you are due an HMRC tax refund, HMRC will inform you by sending out a simple assessment letter or the P800 letter by post.

This assessment or P800 letter usually arrives after the tax year has ended in April of every year. With the help of this letter, you can find out if you can claim your tax rebate online through the government’s website. The key to pay attention to is that this letter will not ask you to provide personal or bank details to claim your tax rebate.

Once your tax has been claimed online via the safe HMRC website, the refund will be credited to your registered bank account within 5 days.

You have another choice too. You could wait 45 days and HMRC will send a tax rebate cheque to you by post.

If you think you’ve overpaid your tax but haven’t received an assessment or P800 letter, you can use the government’s income tax calculator to find out how much you should have been paid back.

3 Most Common HMRC Tax Refund Scams to know

Let’s look at a few common HMRC phishing scams that many people are often subject to, which have been reported and shared by organizations to create more awareness.

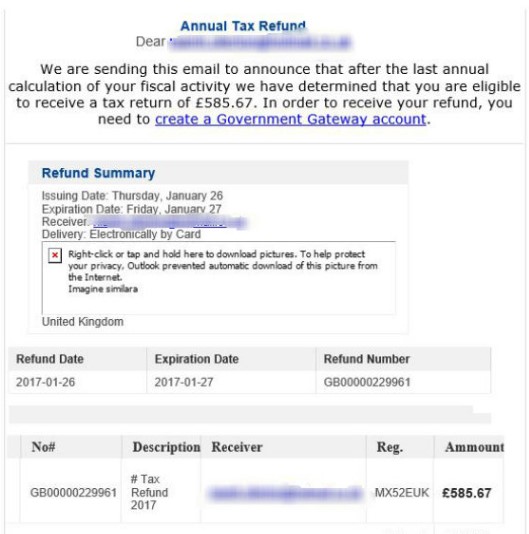

1. Annual Tax Refund Scam

This email will read something like

“This is to inform you that after the last annual calculation of your fiscal activity, we have determined that you’re eligible to receive a tax rebate of _____. To receive this refund, you need to create a Government Gateway Account”.

Then this “Government Gateway Account” link would redirect you to a page that could extract your personal information like this:

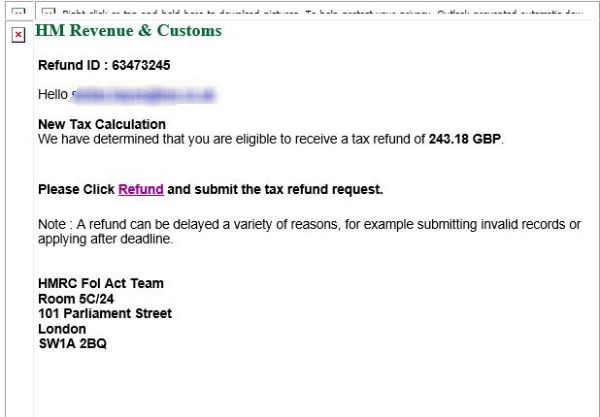

2. New Tax Collection Scams

This email will read, under the subheading “New Tax Calculation”:

“We have determined that you are eligible to receive a tax refund of ____”

It will also try to get the recipient to click on a tax refund link to extract personal information as shown here:

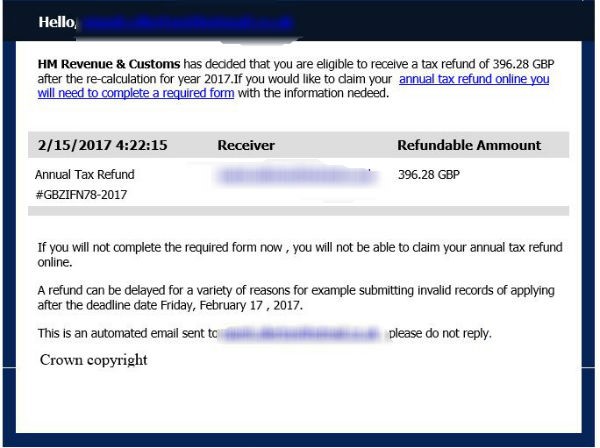

3. Classic ‘Tax Refund’ Scam

Yet another authentic-looking tax scam email but with dodgy English is this one. This classic HMRC tax refund scam email will read something like

“You are eligible to receive a tax refund of _____”.

Through a link, it will attempt to take you to a page claiming to have a “form” that you need to complete to get your tax refund that looks like this:

7 Types of HMRC Phishing Scams to be aware of

1. Email scams

Many people, using sophisticated techniques, can now easily replicate authentic email addresses. But, unlike an email from HMRC, these fake emails would aim to extract personal information from you, such as bank details and other forms of identification as seen in the above examples.

Many people, using sophisticated techniques, can now easily replicate authentic email addresses. But, unlike an email from HMRC, these fake emails would aim to extract personal information from you, such as bank details and other forms of identification as seen in the above examples.

One very common HMRC phishing scam is an email that tells you you’re eligible to get an employment income support scheme in light of the pandemic. There’s also a “failed direct debit” scam that’s going around that claims you entered the wrong bank details to claim your refund and you now have to enter it again.

2. Text scams

Texts that claim to be from HMRC, asking you for financial or personal information, are far too common. Never reply or open any links in these text messages and use a spam filter on your phone where possible so they will be highlighted as spam texts automatically.

Texts that claim to be from HMRC, asking you for financial or personal information, are far too common. Never reply or open any links in these text messages and use a spam filter on your phone where possible so they will be highlighted as spam texts automatically.

3. Phone scams

These types of scams usually target the elderly and vulnerable. One such example of an automated message is one that conveys the recipient has been awarded a tax refund. They need to press 1 to connect with a caseworker to make a payment and once they speak to a real person, it is difficult for them to escape the situation without being persuaded to share their bank details. If you ever receive such a call, end it immediately.

These types of scams usually target the elderly and vulnerable. One such example of an automated message is one that conveys the recipient has been awarded a tax refund. They need to press 1 to connect with a caseworker to make a payment and once they speak to a real person, it is difficult for them to escape the situation without being persuaded to share their bank details. If you ever receive such a call, end it immediately.

4. HMRC refund companies

You may receive texts or emails that offer to apply for a tax refund on your behalf in exchange for a fee. Just know that these refund companies aren’t connected with HMRC in any way.

5. WhatsApp scams

Remember that HMRC will never reach out to you on WhatsApp to talk to you about a tax refund. But, unfortunately, HMRC WhatsApp scams, just like HMRC text and email tax refund scams, are far too common and should be reported to WhatsApp immediately by blocking the number and sharing the reasons why.

Remember that HMRC will never reach out to you on WhatsApp to talk to you about a tax refund. But, unfortunately, HMRC WhatsApp scams, just like HMRC text and email tax refund scams, are far too common and should be reported to WhatsApp immediately by blocking the number and sharing the reasons why.

6. Social media scams

There has been a distribution of direct messages via social media platforms like Twitter that claim to offer tax refunds. HMRC would never use social media platforms to inform you of a tax refund, so again block them and report them.

There has been a distribution of direct messages via social media platforms like Twitter that claim to offer tax refunds. HMRC would never use social media platforms to inform you of a tax refund, so again block them and report them.

7. HMRC customs duty scams

Due to some changes introduced by HMRC officially on 1 January 2021, some UK customers who buy goods from EU businesses may need to make customs charges upon delivery. This update has caused an increase in HMRC phishing scams via text or email asking people for customs duty payments. If you’re not expecting a delivery or parcel, do not reply.

Due to some changes introduced by HMRC officially on 1 January 2021, some UK customers who buy goods from EU businesses may need to make customs charges upon delivery. This update has caused an increase in HMRC phishing scams via text or email asking people for customs duty payments. If you’re not expecting a delivery or parcel, do not reply.

How Do You Prevent These HMRC Scams?

Be it HMRC tax refund scams or any other phishing scams, take note of the following:

Be it HMRC tax refund scams or any other phishing scams, take note of the following:

1. Check the email greeting

If the email greets you as “Dear Customer”, it’s most likely a bogus email.

2. Check the senders’ address

Remember that an authentic HMRC email address would end with @hmrc.gov.uk.

3. Do NOT open any links or attachments

HMRC never asks you to open links or attachments that require you to enter personal or bank details. So, any text message or email that includes links or attachments with such requests is a bogus one and any personal data should only be added via the safe HMRC gateway.

4. Genuine organizations won’t ask for personal details

Out of the blue, there is no way that HMRC or any bank or organization is going to ask you for your bank details such as a password, or a pin, if they’re authentic and trustworthy.

5. Take action

The next time you receive phishing emails or are subject to HMRC tax refund scams, forward these suspicious messages to phishing@hmrc.gsi.gov.uk. You can even look up GOV.UK for information on how to prevent scams and report them and identify genuine HMRC contacts.

Closing Thoughts

Hopefully, this guide has provided you with valuable information about how to identify and report HMRC tax refund scams circulating in the UK to keep your financial health balanced. But if you want more information on this matter, you can head to these governmental guidance articles:

Phishing and bogus emails HM Revenue & Customs Examples

Check if an email you have received from HMRC is genuine

HMRC warns on tax refund scams

Or report any suspected fraud to the National Fraud Intelligence Bureau called Action Fraud and you can find all types of frauds they deal with here.

Author Profile

- Online Media & PR Strategist

- As the Chief of Marketing at the digital marketing agency ClickDo Ltd I blog regularly about technology, education, lifestyle, business and many more topics.

Latest entries

Business AdviceMarch 27, 20259 Ways Technology Helps Businesses Offer Better Promotions

Business AdviceMarch 27, 20259 Ways Technology Helps Businesses Offer Better Promotions Health & BeautyMarch 16, 2025Top 15 Dentists in London – Private Emergency Dentist

Health & BeautyMarch 16, 2025Top 15 Dentists in London – Private Emergency Dentist Health & BeautyMarch 15, 2025Best 14 Orthodontist & Cosmetic Treatment Clinics in London

Health & BeautyMarch 15, 2025Best 14 Orthodontist & Cosmetic Treatment Clinics in London Business AdviceMarch 10, 2025How Automation is Transforming Team Workflows

Business AdviceMarch 10, 2025How Automation is Transforming Team Workflows